Author: Xinhua Daily Telegraph reporter Shao Xiangyun Huang Jianglin Liu Weizhen Yin Siyuan

The water level of the river continued to fall, and some people affected by the disaster returned to their homes, and more than 2.4 billion cubic meters of flood water was discharged into the sea … …

On August 17th, in Shaoqidi Village, Huanghuadian Town, wuqing district, Tianjin, Kou Zhiming (second from left), director of the village committee, welcomed the villagers back to the village. Xinhua Daily Telegraph reporter Sun Fanyue photo

After more than 20 days and nights of fighting, Tianjin’s flood control and relief work has achieved initial results.

Affected by Typhoon Du Surui, since the end of July, there have been heavy rains in many places in the north, and a basin-wide flood has occurred in Haihe River. As the main "estuary" of floods in Beijing-Tianjin-Hebei region, Tianjin undertakes 75% of the flood discharge tasks in Haihe River Basin.

For Tianjin, which is low-lying and located at the end of the Nine Rivers, this is a big battle and a big test.

"No casualties, no dam collapse, no breach of important dikes and no impact on important infrastructure". In order to achieve this goal, the cadres and the masses and the officers and men of Tianjin party member have been sticking to the front line so far.

Officers and men of a detachment of the First Mobile Corps of the Armed Police Force rushed to build a dam at the Daqinghe Branch Canal Bridge (photo taken on August 10, photo of drone). Xinhua Daily Telegraph reporter Zhao Zishuo photo

(A) "wake up step by step, all response"

On July 29, the rainstorm was like a note. In the Tianjin Emergency Rescue Command Center, the big screen flashes real-time meteorological dynamics and river regime … …

The forecast of possible floods in Ziya River, Yongding River and Daqing River came, and the staff looked nervous: there may be a severe situation of three floods in Tianjin. This is a situation that has not happened for many years!

That night, Tianjin urgently convened all parties to discuss the grievances. In the early morning of the next day, after the meeting, Tianjin immediately launched a flood control level III emergency response.

A flat and efficient command system was also quickly launched.

— — Responsible comrades of all departments went to the front line of flood control and flood fighting to deploy and dispatch flood control and mass transfer and resettlement work.

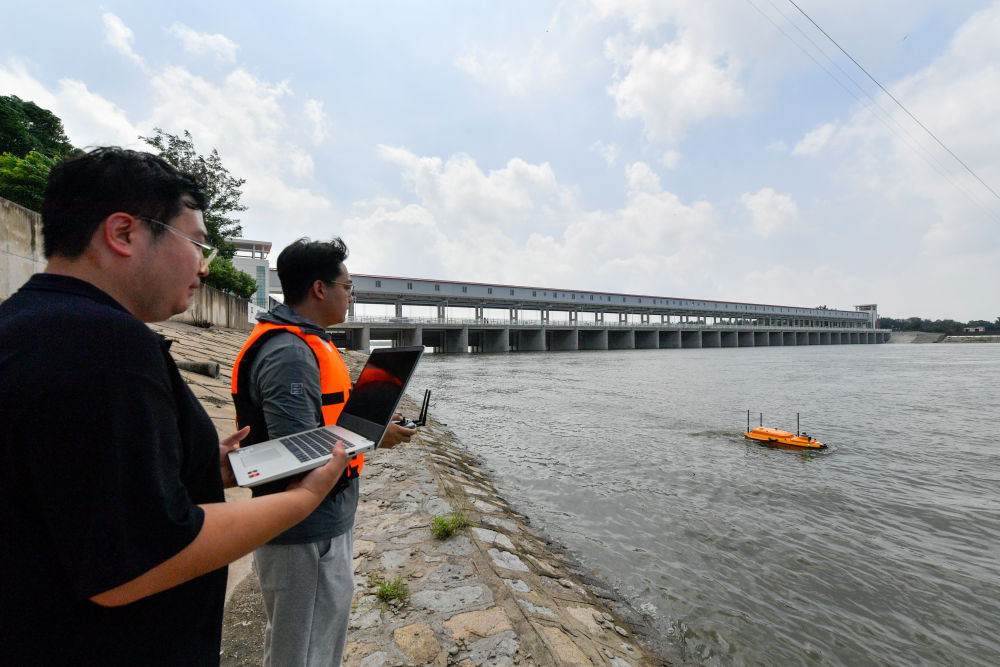

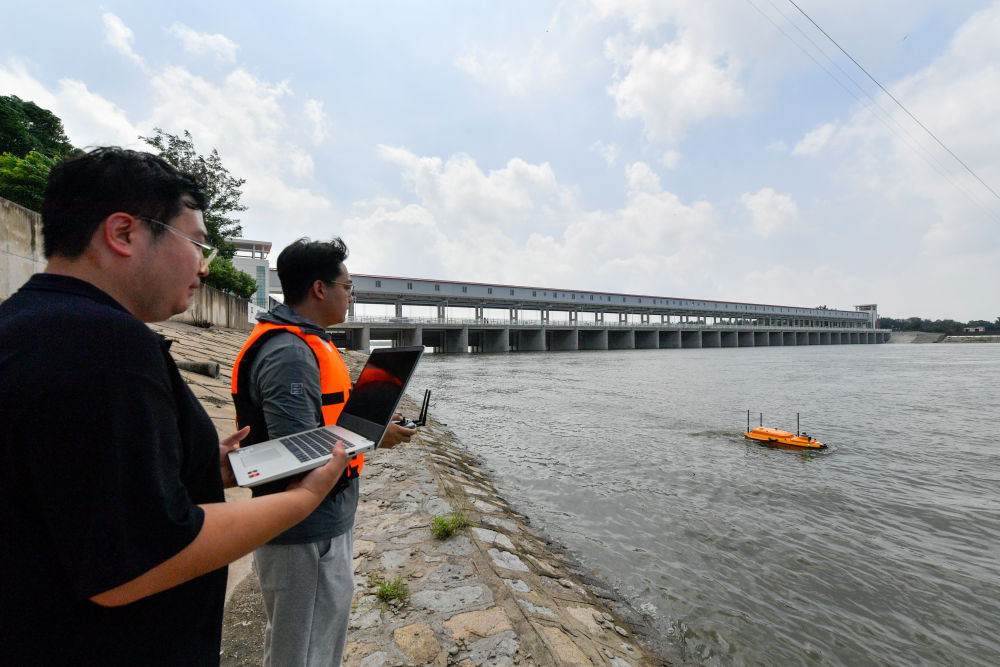

On August 2nd, hydrologists operated an unmanned hydrologic monitoring ship for hydrologic monitoring at the upstream of the flood gate of Duliujian River in Tianjin. Xinhua Daily Telegraph reporter Sun Fanyue photo

— — Meteorology, water affairs, emergency, public security, urban management, fire rescue, etc. quickly deploy professional backbones to the emergency rescue command center to ensure wake-up call.

— — In accordance with the plan, all districts should ensure the smooth flow of information and do a good job in flood control, emergency rescue and disaster relief.

… …

As the flood situation intensifies, Tianjin will first prepare to open the Yongding River floodplain. On the afternoon of July 31, more than 35,000 people in the Pan-area were transferred in just 10 hours.

At 1 am on August 1, Tianjin launched a flood control level I emergency response. At 2 o’clock in the morning, the Dongdian flood storage and detention area was opened. The main responsible comrades of the Tianjin Municipal Party Committee and Municipal Government rushed to the front line for several days to dispatch flood control and emergency rescue and mass transfer and resettlement work. All districts and departments in the city take their positions and perform their duties. Cadres and the masses took to the dam in the rain, reinforced the dam and investigated hidden dangers … …

In Taitou Town, Jinghai District, Tianjin, Lei Zhu, deputy mayor of Taitou Town, made an inspection tour on the north bank (photo taken on August 13th). Xinhua Daily Telegraph reporter Li Ran photo

Tianjin fangzhi coordinated the implementation of 145,600 rescue teams at the city and district levels, waking up step by step, responding fully and updating daily.

Wang Jiangang, a retired cadre of the Marine Commission of the Ministry of Water Resources, saw the serious flood in the Haihe River basin, volunteered to come to the Yongding River floodplain, waded with young people to check the dangerous situation, analyzed where the dangerous section was, and how to get into the floodplain, and made suggestions.

"The Yongding River has not been flooded for a long time, and it is necessary for me to make another effort to defend against the flood." Wang Jiangang said.

In the "rear area", the disaster relief materials reserve and allocation departments are also at full capacity to ensure the front-line demand in an orderly manner.

On August 3, in Taitou Town, Jinghai District, Tianjin, workers participated in the heightening and reinforcement of the dam on the north bank of Daqing River. Xinhua Daily Telegraph reporter Sun Fanyue photo

Vehicles carrying flaky piles, sand and stone materials lined up in a long line, busy and orderly entering and leaving the rescue site. In the notebook of Zeng Tianrong, the chief of the Disaster Relief Coordination Section of Jinghai District Emergency Management Bureau, a series of material accounts were clearly and accurately recorded. Because of many days of high-intensity work, Zeng Tianrong’s voice has been hoarse. He told reporters: "We are on duty 24 hours a day, responding to emergency needs at any time to ensure that materials are supplied in time."

Up to now, Tianjin has successfully responded to the flood peak crossing, investigated and handled more than 60 dangerous situations such as dam leakage and piping, and allocated more than 30 kinds of flood control and rescue materials such as geotextile, sand, cement and life jackets, effectively ensuring the first-line flood control and rescue.

The emergency rescue team is handling sandbags to deal with the seepage of the dam near Beiwei, Qingbei District, Taitou Town, Jinghai District, Tianjin (photo taken on August 15). Xinhua Daily Telegraph reporter Zhao Zishuo photo

(B) "One more minute of water discharge, the upstream water level may drop by one centimeter."

"The upstream incoming water level is 10 cm higher than the downstream tidal water level."

"Continue to vent!"

This is the floodgate of Duliujian River, which was photographed from a helicopter, where Daqing River and Ziya River merge into Duliujian River (photo taken on August 8). Xinhua Daily Telegraph reporter Sun Fanyue photo

At 17: 00 on August 12, the Daqing River flooded into the sea — — In tidal gate, where the river is reduced by Duliu River, the staff is determining the gate state according to the change of water level and tidal level.

Xing Jun, director of the tidal gate Management Office of Duliujian River, Haihe Downstream Management Bureau of the Ministry of Water Resources, told the reporter that the opening and closing time of the sluice should be changed in real time according to the water level and tide level, and the water level should be closely watched for 24 hours. As long as the incoming water level is higher than the tide level, the sluice will be lifted immediately to discharge flood. He said: "One more minute of water discharge, the upstream water level may drop by one centimeter."

On August 9th, the tidal gate opened for 23 hours, setting a new high of 80.78 million cubic meters of flood discharge in a single day.

Tianjin has a dense river network and developed water system. The South Canal, North Canal, Ziya River, Daqing River and Yongding River converge into the sea in Tianjin.

Tianjin Duliujian River enters Hongnan Gate, which was filmed on August 2nd. Xinhua Daily Telegraph reporter Sun Fanyue photo

According to Li Baoguo, a senior engineer of Tianjin Research Institute of Water Conservancy, the flood discharge process is mainly to let the Yongding River flood into the sea from the Yongding New River, the Daqing River flood into the sea from the Duliu Jianhe River, and the Ziya New River flood into the sea from the Ziya New River. He said: "Only when the upstream and downstream cooperate can Tianjin flood more efficiently."

In this battle against catastrophic floods, all localities and all aspects cooperated with each other to ensure the scientific, efficient and orderly work of flood control and flood relief.

Tianjin Water Affairs Department coordinates the upstream and downstream, consults the water and rain conditions in linkage, communicates meteorological and dispatching measures, and issues flood forecasts rolling by river system, providing information support for the next flood parade.

Wang Hongfu, deputy director of Tianjin Water Affairs Bureau, said that with the support of upstream rain and water information, they constantly revised the arrival time of water from Daqing River in Tianjin. On August 3, they provided accurate forecast information to the headquarters one day in advance, which grabbed sufficient preparation time for the smooth flood discharge in Dongdian flood storage and detention area.

The staff inspected the warehouse in Tianjin Relief Materials Reserve Station (photo taken on August 16). Xinhua Daily Telegraph reporter Li Ran photo

According to Xue Feng, deputy section chief of the Information and Statistics Department of the Affairs Center of Tianjin Emergency Management Bureau, on the afternoon of August 8, Tianjin applied for flood control materials support, and the central relief materials were shipped that evening. Subsequently, disaster relief materials shipped from the central disaster relief material reserve were delivered to Tianjin one after another.

With the strong support of the State-owned Assets Supervision and Administration Commission of the State Council and the Emergency Management Department, more than 15,000 people from 86 units of 13 central enterprises, including China Anneng, China Railway, China Railway Construction and State Grid, quickly gathered in Tianjin to fully support the flood fighting and rescue work.

In the early morning of August 9th, in Taitou Town, Jinghai District, Tianjin, firefighters from tianjin fire Rescue Corps patrolled the Revolutionary Bridge. Xinhua Daily Telegraph reporter Sun Fanyue photo

Officers and men of the People’s Liberation Army and the Armed Police also came … …

Unity is strength, invincible. Up to now, Tianjin has accumulated more than 3 billion cubic meters of upstream floods, and more than 80% of them have been discharged into the sea.

Officers and men of a detachment of the First Mobile Corps of the Armed Police Force filled sandbags used to reinforce dams at the rescue site (photo taken on August 11). Photo by Xinhua Daily Telegraph reporter Zhao Zishuo.

(3) "Notice from door to door to ensure that no one is left behind"

On August 12th, Zhang Jiaquan, a villager from Pangzui Village, Beichen District, Tianjin, returned to his home. On July 31, after the emergency transfer with more than 2,000 villagers in the village, he has lived outside the village for 13 days.

The streets and lanes have been cleaned. Seeing that more than 100 piglets raised by his family grow well, Zhang Jiaquan is grateful to the cadres in the village.

On the day of leaving home, the village cadres helped him look after these little guys together.

In Taitou Town, Jinghai District, Tianjin, Cai Jie, director of Taitou Police Station, helped transfer people to feed pigs (photo taken on August 13). Xinhua Daily Telegraph reporter Li Ran photo

Duan Yi, the first resident secretary of Pangzui Village, said that during this time, they have been patrolling the village and the river, helping the villagers to feed livestock and poultry, doing disinfection and epidemic prevention in advance, and waiting for the villagers to go home.

On August 17, the staff carried out disinfection work in Taitou Town, Jinghai District, Tianjin. Xinhua Daily Telegraph reporter Zhao Zishuo photo

The tension before the flood is still vivid.

Since July 31, numbered floods have occurred in Yongding River and Daqing River, and the Yongding River floodplain and Dongdian flood storage and detention area have been opened.

Shaoqidi Village, wuqing district, Tianjin, located at the junction of Tianjin and Hebei, is the "first stop" for Yongding River to enter Tianjin. At 22: 00 on August 1, the flood head of Yongding River arrived here. The day before, all the people in the village had moved.

Kou Zhiming, secretary of the Party branch of Shaoqidi Village and director of the village committee, said: "We have set up a special work class to notify from house to house to ensure that no one is left behind."

After receiving the evacuation order, Wuqing, Beichen, Jinghai and Xiqing, which are involved in the Yongding River floodplain and the Dongdian flood storage and detention area, raced against time to set up more than 20 relocation sites and relocated more than 86,000 people, of which more than 5,480 people were resettled.

The protection of resettlement sites is also warm.

The Gaoshu couple in their 60 s were the first villagers to move to the resettlement site of Shuigaozhuang Industrial Park in Xiqing District. A dormitory converted from an office is simple and warm. According to Gao Shusheng, meals are delivered, and there is air conditioning in the room, so food and shelter are all good.

Transfer people to look after children in the resettlement site of Qinhe Confucian Garden in Xiqing District, Tianjin (photo taken on August 9). Xinhua Daily Telegraph Photo by Li Ran

"We have set up a special working group, and the people’s meals, medical treatment and living materials are guaranteed." Pan Yuxin, deputy director of the Standing Committee of Jinghai District People’s Congress stationed at the resettlement site of Chilong South Street, said.

The care of the disabled and demented group is a major difficulty in the transfer and resettlement work. In Jinghai District, Haifuxiang Nursing Home specially received more than 140 older villagers with basic diseases and mobility difficulties.

In Haifuxiang Nursing Home in Jinghai District, Tianjin, the staff assisted their families to send people who were inconvenient to move to temporary resettlement sites to the nursing home (photo taken on August 3). Xinhua Daily Telegraph reporter Sun Fanyue photo

An old man who had suffered from cerebral hemorrhage had hematuria symptoms after coming to the hospital. The nursing staff contacted Tianjin Jinghai District Hospital at the first time and sent the old man to the hospital for treatment with an ambulance. The patient was out of danger.

The medical staff told the elderly to transfer medication in the resettlement site of Haifuxiang Nursing Home (photo taken on August 9). Xinhua Daily Telegraph reporter Li Ran photo

Zhang Junwu, deputy commander of Tianjin’s flood prevention index and director of the Tianjin Emergency Management Bureau, said that according to the deployment requirements of the city’s flood prevention index, all relevant districts quickly launched the application plan for flood storage and detention areas, and refined the step-by-step transfer measures of "investing in relatives and friends, special people and centralized resettlement" to fully protect the lives of the transferred people.

The people in Tianjin Dongdian flood storage and detention area and Yongding River flood area "should turn around" and there were no casualties.

As the flood recedes, more and more displaced people return to their homes.

In terms of the appearance of 23 Dodge Challenger SRT Hellcats, the new car continues the American muscle car style with very tough and powerful challenger family models. At the same time, the new car has added a set of wide-body kit on the basis of the ordinary version, which is mainly aimed at widening its wheel eyebrows, and has increased by 3.5 inches (88.9mm) compared with the ordinary version, enabling the new car to use wider tires. In addition, the new car will also provide 13 different body colors, and provide a variety of body pull flowers for consumers to choose from. Car hotline: Liu Jingli 15222407919 "With WeChat"

In terms of the appearance of 23 Dodge Challenger SRT Hellcats, the new car continues the American muscle car style with very tough and powerful challenger family models. At the same time, the new car has added a set of wide-body kit on the basis of the ordinary version, which is mainly aimed at widening its wheel eyebrows, and has increased by 3.5 inches (88.9mm) compared with the ordinary version, enabling the new car to use wider tires. In addition, the new car will also provide 13 different body colors, and provide a variety of body pull flowers for consumers to choose from. Car hotline: Liu Jingli 15222407919 "With WeChat"

Tianjin Bangyu Automobile International Trading Co., Ltd. is a company that sells (Mercedes-Benz), (BMW), (Porsche), (Land Rover), (Audi),

Tianjin Bangyu Automobile International Trading Co., Ltd. is a company that sells (Mercedes-Benz), (BMW), (Porsche), (Land Rover), (Audi),