[car home Engine Technology] Under the tide of turbine direct injection, various car companies have come up with their "good tricks" to deal with this trend. So under this tide, which displacement has become a treasure for major car companies to seize? Non-2.0T group. In order to make the engine have a lower displacement, at the same time, it can have the same power as a six-cylinder engine, and it also has a better performance in economy. The 2.0T four-cylinder supercharged engine can be said to have the advantage.

Since it is a battleground for military strategists, there must be a variety of engine products for our consumers to choose from in this displacement group, and you must have seen them dazzling. By the end of the year, let’s take stock of those mainstream 2.0T supercharged engines together, so that you can have a clear understanding and comparison of them.

Note: This year-end inventory, please see the officials don’t cause bad influence in the comment area, each engine has its own advantages and disadvantages, please look at it rationally, thank you for your understanding.

● Why do major manufacturers choose the displacement of 2.0T?

To understand this kind of engine, we must first know why many manufacturers love 2.0T: on the one hand, its displacement is not too small, the cylinder diameter and stroke of each cylinder are relatively balanced, and the ride comfort performance is acceptable; On the other hand, after the 2.0L engine is equipped with a supercharger, its power is comparable to that of some six-cylinder engines with larger displacement, and even many manufacturers regard the 2.0T four-cylinder supercharged engine as a "substitute product" of their old six-cylinder naturally aspirated engine. Most importantly, under the condition of ensuring sufficient power, generally speaking, a 2.0T four-cylinder engine is more economical and fuel-efficient than a V6 engine with larger displacement, and it also has some advantages in displacement tax.

Among the 2.0T engines, in order to differentiate their power output levels, many brands have matched 2.0T engines with roughly the same structure but different adjustments on different models. On the one hand, it can be seen that the 2.0T engine benefits from the advantage of moderate displacement, which has the characteristics of wide power coverage and adaptability to many models. So how do these different versions of 2.0T do it?

Some engines can be realized simply by ECU, but most engines have different degrees of enhanced design for many engine components except the multi-power version of ECU. So why do you say this here? Friends who brush ECU, you must think carefully, and if you can, you’d better do some engine strengthening work (don’t ask me how I know! Who is young and has never made a mistake! )。

Below, according to different brands, we will divide them into two groups of 2.0T products for spicy evaluation. There will be a certain degree of spit in front of high energy, so don’t be too serious.

● Overseas brand group: the technology is basically formed and the power coverage is wide.

1. The controversial pioneer: Volkswagen EA888 2.0T

Old friend EA888 must be familiar to everyone. I remember that around 2006, the first batch of fifth-generation GTI imported into China adopted the combination of 2.0TSI+6-speed DSG, which was the first time I came into contact with Volkswagen’s "legendary powertrain" in China. As for how magical this thing was at that time, a set of data is enough to explain everything: the power is 100Ps, and the acceleration of 100 kilometers can reach 6.9s with the dual-clutch gearbox. The appearance price of "hatchback sagitar" is about 400,000. Ten years ago, it was absolutely "no friends" to sell it to China at this level.

I don’t know if the data is amazing to other manufacturers. After the increase of direct injection from Volkswagen EA113, many manufacturers gradually began to compete to develop direct injection supercharged engines. On the other hand, now, direct injection supercharged engines are popular, stealing the limelight of many self-priming engines, coupled with increasingly severe emission regulations and tax policies, and now cars are embarrassed to say hello to others without supercharging.

Indeed, people are afraid that famous pigs are afraid of being fat. While EA888 attracts people’s attention, the problem of burning engine oil also gives many car owners a headache. The specific reason can be seen in the EA888 disassembly article we wrote before: EA888 disassembly. This engine is not hacked here. As far as things are concerned, the probability of burning engine oil is really high, but the third generation EA888 has made improvements on the oil pipeline and oil-gas separator, and the actual effect has indeed improved. Another problem is that this engine inherits the "grandfather-class" cylinder block of EA113 and adopts cast iron. Although it has certain advantages in strength, it is too old. The cylinder block sinks and radiates heat, and it is not a problem for the current cast aluminum alloy technology to achieve high strength.

2. Built an engine like a playmate: BMW B48 2.0T

Another engine that is now on fire should be the BMW B-series engine. Different from EA888 years’ production, BMW B-series engine is a "young man". This engine was born to gradually replace the N-series engine that has been manufactured for many years. If you know BMW, you should be very clear that the B-series and N-series engines are definitely completely redesigned.

Yes, unlike N-series engines, B-series engines adopt a modular design concept. No matter how many cylinders and displacement, the parts between engines are still very replaceable. This is because at the beginning of the design, engines with different displacements used single cylinder size data with uniform specifications (cylinder diameter: 82mm, stroke: 94.6mm, ideal displacement of single cylinder: 0.5L), and changing the displacement is nothing more than the process of cylinder increase and cylinder decrease (special case: B38A-12A engine), and in the process of engine development, many structures matched with engines with different displacements can achieve unified design. In this way, engines with different displacement cylinders are just like "Lego", which is much easier to realize in design.

This engine can be said to incorporate many popular advanced engine technologies: water-cooled intake, integrated exhaust of cylinder head, cylinder liner design, etc., and retain the direct injection technology, valve timing and lift adjustment. Although there is not much improvement in parameters compared with N20, the power output level covered by the original factory is still very wide due to the strengthened water cooling system. (Want to know more about B48? Poke the link: B48 engine analysis)

So this engine must be perfect? In fact, there is still room for improvement. For example, at present, an electronically controlled mechanical water pump is used, and in the future, an independent electronic water pump can be considered to replace it. In addition, due to its high degree of integrated design, this engine may not be as convenient as N20 for friends who want to modify it later.

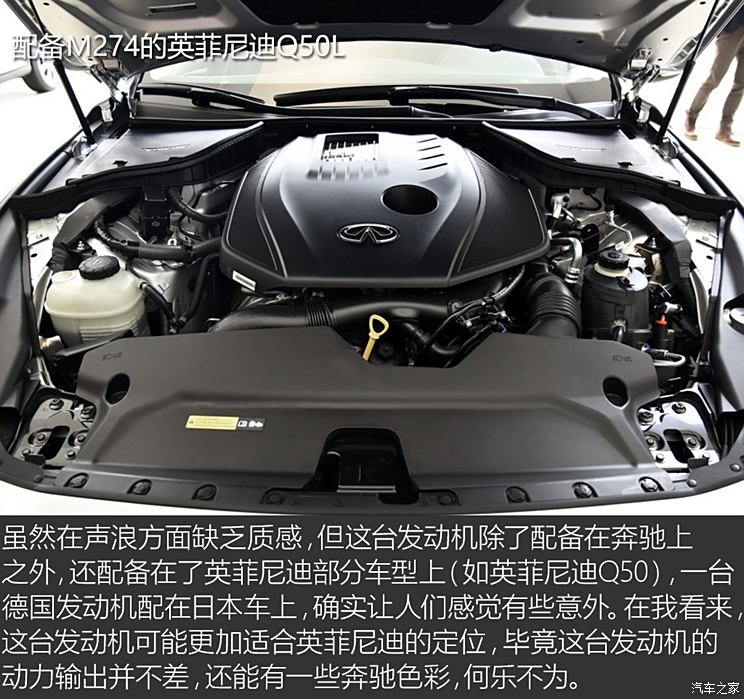

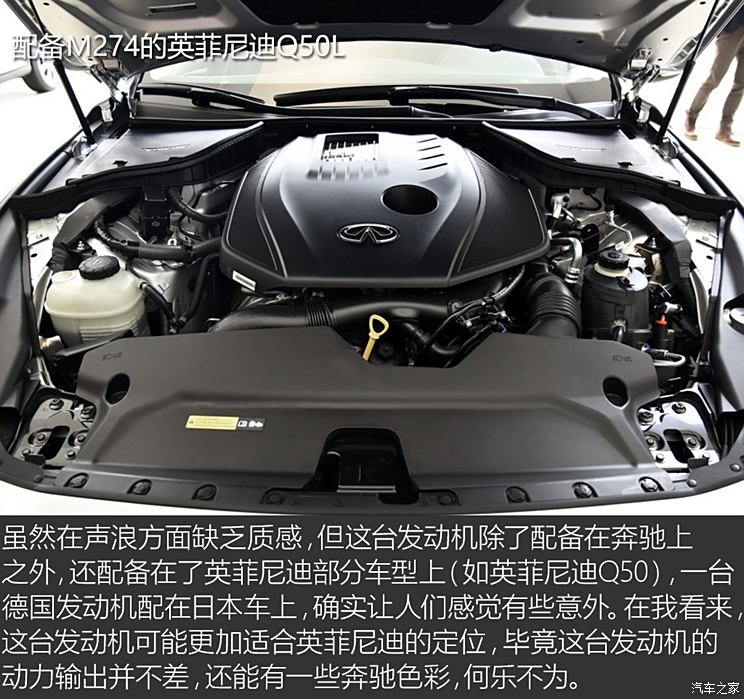

3. Germany and Japan share: 2.0t Mercedes-Benz M274/M270 (called 274930/274A) 2.0T Nissan).

Volkswagen BMW has its own 2.0T, and German car pioneer Mercedes-Benz will definitely not fall behind. Under the tide of direct turbine injection, Mercedes-Benz also entered the 2.0T turbine era in 2011: two engines codenamed M274 (vertical) /M270 (horizontal) were put into production cars to replace the four-cylinder supercharged engine before Mercedes-Benz.

Like many brands, Mercedes-Benz, which has tasted the sweetness, even wants this engine to try to replace the original low-power six-cylinder naturally aspirated engine, but there is a problem here: Mercedes-Benz, as a luxury brand that Germans are proud of, will make people think that Mercedes-Benz "does not pursue texture" in the practice of "reducing cylinders". And the truth? While affirming the advantages of this engine in technical level and power output, the sound of this engine is really not very good.

In fact, this kind of "transnational cooperation" is not the first time. Nowadays, many brands have realized the exchange of needed goods, and the future trend must be to create a "global car" that the whole planet likes. If you experience many German and Japanese brand new cars yourself, you will find that the driving quality between them is very similar to that before, and the concept of "a certain car" will become more and more faded, so it is only good to share good things. Although this engine has not been produced for a long time, this M274/M270 is nearing replacement, and the new Mercedes-Benz four-cylinder turbine engine is being developed and tested. As for the new machine, we will wait and see. (Want to know more about M274/M270? Poke the link: M274 engine analysis)

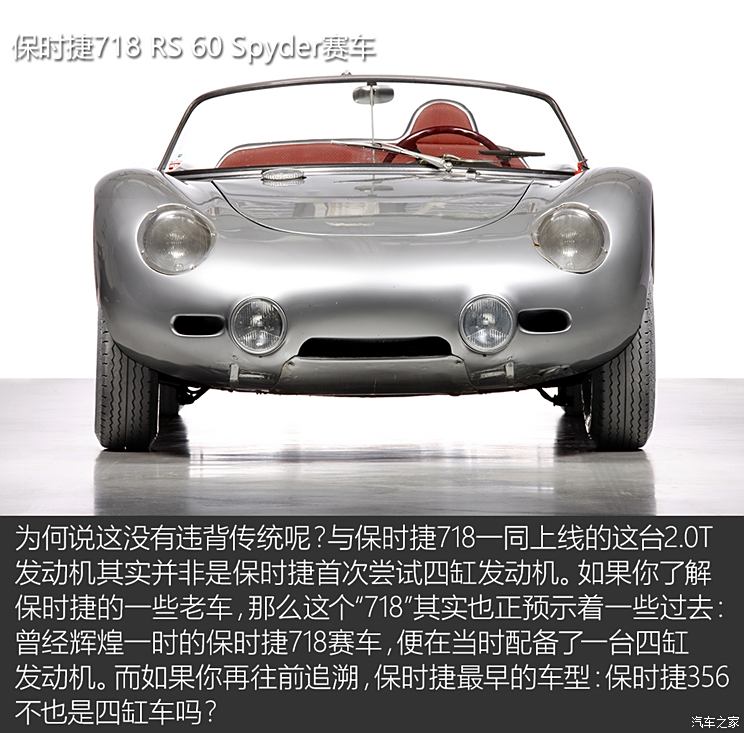

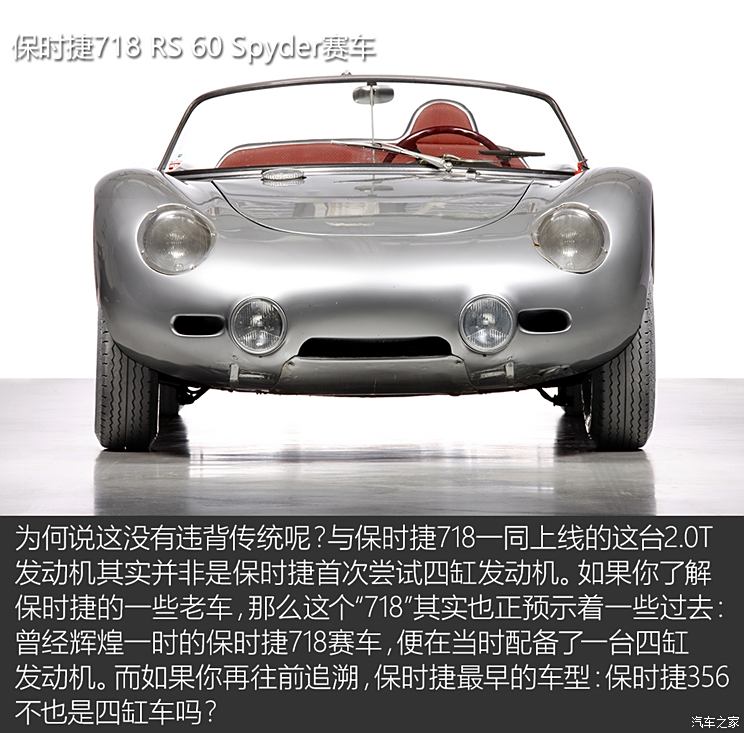

4. Regain the four-cylinder water alignment: Porsche horizontally aligns 2.0T

Yes, there is one engine that has caused great controversy in the matter of "cylinder reduction", that is, Porsche horizontally opposed four-cylinder 2.0T turbocharged engine. "What? Porsche gave up the horizontally opposed six cylinders and switched to a four-cylinder turbine? What is the difference between that and Subaru? " Don’t rush to deny this engine, at least it’s not against tradition.

Since it does not violate tradition, what are the advantages of this engine? Please, this is a product of the new era. Porsche will not be stupid enough to give up a successful project before and invest in a failed project. Let’s start with the improvement brought by this engine: Compared with the Boxster/Cayman equipped with a 2.7L horizontally opposed six-cylinder engine, this 2.0T engine is faster in speed, more economical and fuel-efficient and lighter in weight. While retaining the proper handling of Porsche, it also makes this car "more people-friendly": the official quotation and the purchase tax of displacement tax are lower, which makes it easier for you to realize the dream of Porsche sports car (although I still can’t afford it).

In a sense, the replacement of this engine is successful, at least it can make more people feel the charm of Porsche sports cars with less money. Of course, in the end, we still have to vomit a little shortcoming of this seemingly perfect engine: the sound is not as rich and charming as before. I’m not alone, but many people think so. Like Mercedes-Benz 2.0T, it lacks a sense of sophistication.

5. Materialist: Toyota 8AR-FTS2.0t.

To say that the most famous brand in the world is Toyota. Practical, easy to open, worry-free and cheap is the reputation that Toyota has laid for many years. Lean production and practical design have carried out the whole Toyota brand, and of course, the same is true for engines. It is not only necessary to integrate the current advanced technology, but also reliable and durable, and it is also very cheap to maintain.

Mixed injection, Otto-Atkinson cycle switching, dual VVT and integrated exhaust hood, etc., all make it face a lot of 2.0T engines that claim to be technologically advanced. Indeed, if you have studied this engine carefully, you will find that this engine combines almost all the advanced gasoline engine technologies that are popular at present. From the aspects of fuel efficiency and emissions, this engine has good strength, and it seems that the image of "Toyota’s power is only enough" has been changed.

So why did Toyota go to so much trouble to make this 2.0T engine have so many engine technologies? In fact, it is not difficult to understand that Toyota has never rejected new technologies. On the contrary, it hopes that new technologies can make up for the inherent shortcomings of some turbine engines. It is the original intention of this engine to apply appropriate technologies under suitable engine conditions. In fact, Toyota has also done it. Of course, in theory, with so many technologies integrated, it is indeed difficult to ensure reliability. You know that Toyota is a brand famous for its reliability. What kind of results will this slightly radical approach bring? In addition, according to feedback from some Toyota 2.0T owners, this engine is burning engine oil (there are two examples around, but there are also some cases that may occur, so we are still paying attention and actively communicating with engineers). (To learn more about this engine, poke the link: Lexus 2.0T)

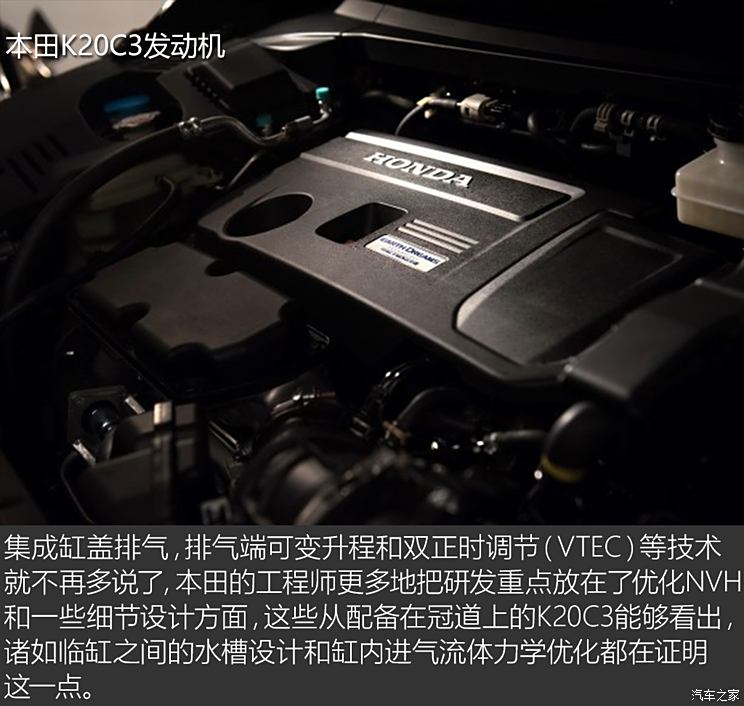

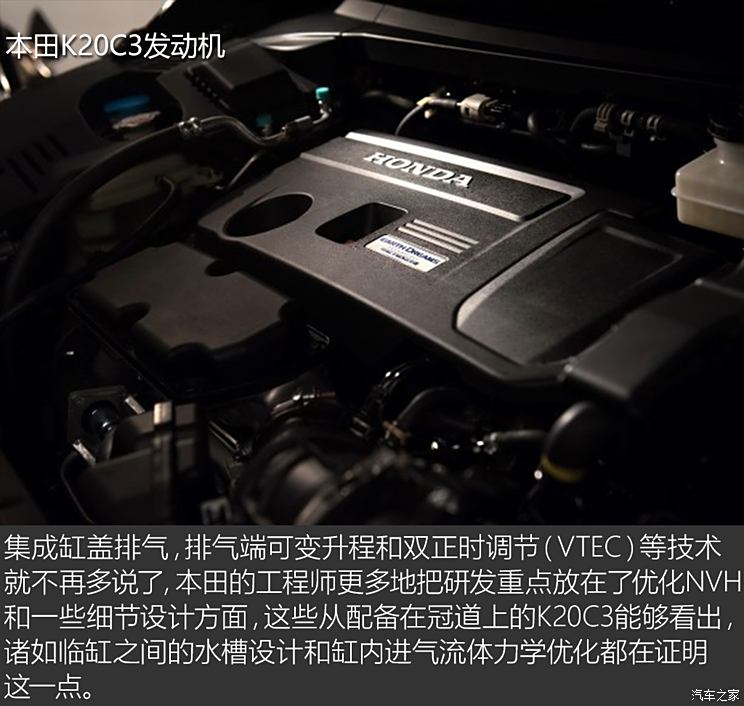

6. TYPE R’s Earth Dream: Honda Earth Dream K20C2.0t.

Speaking of Honda’s big moves in recent years, it belongs to the "EARTH DREAM" engine: the Honda Earth Dream series was born. Indeed, Honda, which has rarely had turbine engines, has finally made some changes: turbocharging and our technology are combined to create an "earth dream" and let new turbine engines spread to their global cars.

In fact, Honda is not without turbocharged technology. A few years ago, Honda tried to equip the previous generation Acura RDX with a turbocharged engine, and then there was no following. The return of turbocharging can be seen as Honda’s return to the test water turbocharging technology again through the turbine trend. And what is the result of this regression? Comparing the K20C3 of Crown Road with the 8AR-FTS 2.0T of Highlander, the output of this engine is very bright, and the actual output performance is equally good.

| Comparison of 2.0T parameters between Toyota and Honda |

| |

Honda 2.0T |

Toyota 2.0T |

| Engine model |

K20C3 |

8AR-FTS |

| displacement |

1996mL |

1998mL |

| Compression ratio |

9.8 |

10 |

| maximum horsepower |

272Ps |

220Ps |

| maximum torque |

370N·m |

350N·m |

Indeed, Honda has produced a powerful engine this time, but if you carefully observe what I said, it is not difficult to find one point: only the exhaust end of the car has the valve lift adjustment function in VTEC. It must be a measure to ensure that the cylinder pressure is not too large and balance the cost. After all, the turbine and direct injection are blessed, and the cylinder pressure is different from before. (For more information about this engine, please poke the link: Honda 2.0T engine disassembly)

7. Variable compression ratio: British finidi VC-T 2.0T

After two days, Nissan seems to be unable to sit still and take out some high-tech 2.0T engines. Under the protection of Mercedes-Benz M274/M270 for several years, Nissan recently took out their "black technology": a 2.0T engine with variable compression ratio, and called it VC-T, and the first batch will be carried in the brand-new British and finidi QX50.

While retaining some popular technologies such as mixed injection and timing adjustment, how does this engine complete the compression ratio adjustment function? In fact, it’s not complicated. Since we dare not change the connecting rod structure of the crankshaft easily, we should find ways to make the crankshaft realize plane displacement and ensure that the piston moves at the same time.

To tell the truth, this move is quite crazy. After the in-cylinder explosion does work, the piston directly transmits the converted kinetic energy to the piston connecting rod, and the connecting rod is directly connected with the crankshaft. To put it bluntly, the three parts are parts that bear great impulse and kinetic energy. Each individual part is generally cast, and even some engines have to go through a further forging process to ensure the strength of these three parts. The newly added eccentric wheel structure also has to bear considerable strength, and the strength of this mechanism will be the key to be considered in the future durability. (For more information about this engine, click the link: British finidi VC-T)

8. Americans feel good: Subaru FA20F is horizontally opposed to 2.0T

Speaking of Subaru’s 2.0T horizontally opposed engine, maybe you, like me, first think of the legendary engine installed in the old STi-EJ20 (want to see the contents of EJ series engines? Poke the link: EJ20 series of classic engines). It is true that in the process of "pinching" with the old EVO equipped with 4G63T, the EJ20 series of Subaru’s strongest horizontally opposed 2.0T engine contributed greatly, and it has a very impressive performance in terms of strength and power output. Today, however, instead of talking about classics, we will go to see a new era product of Subaru: FA20F engine.

This brand-new horizontally opposed four-cylinder turbocharged 2.0T engine can be said to be completely different from the previous EJ20: firstly, the cylinder stroke, the double 86mm design of FA20F, which can give consideration to power emission and economy, and balance the power output at middle and low speeds to a certain extent, which is quite different from the previous EJ20 with high speed orientation. In addition, the aluminum alloy cylinder head also makes it lose a lot of weight, and with the support of Toyota D-4S mixed injection technology, this engine shows a kind of simplicity.

As for the shortcomings, it may be the same eccentric wear problem as Porsche horizontally opposed engine. This is horizontally opposed engine’s congenital structural defect. The piston will be seriously worn on the lower part of the cylinder wall under the influence of gravity, which will lead to a series of problems such as burning engine oil, which can only be strengthened as far as possible and cannot be completely cured. However, these problems will take a long time to appear, and it is most important to eat, drink and be merry.

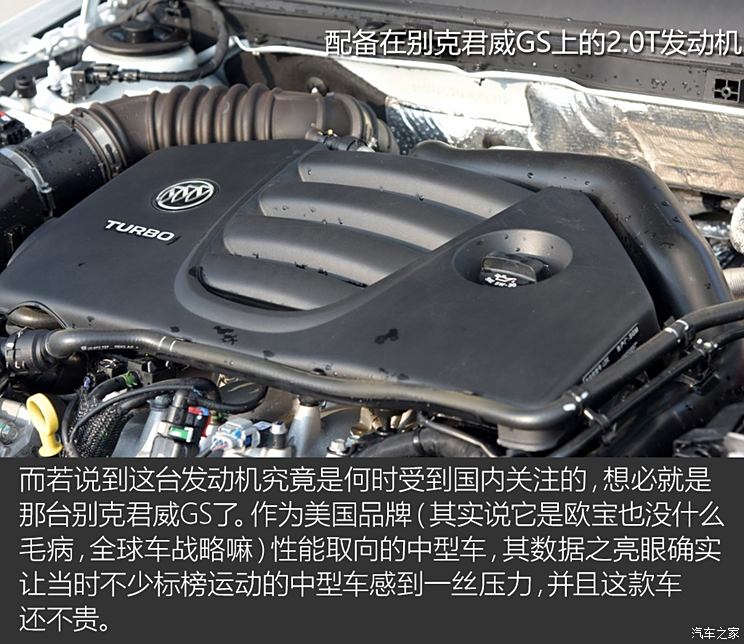

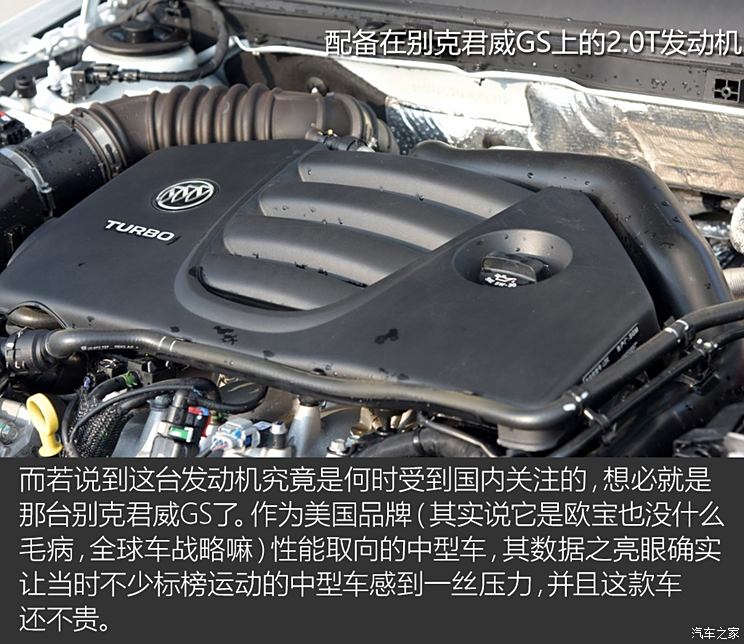

9, when old and strong: general Ecotec LDK 2.0T

GM LDK 2.0T engine can be regarded as one of GM’s counter-offensive horns against European 2.0T engines. Needless to say, in-cylinder direct injection combined with turbocharging technology, it is impossible for European 2.0T players to feel the pressure from the United States without some hard power.

The LDK 2.0T we are going to talk about today is actually the second generation product. GM’s measures to deal with the future are actually similar to those of other brands. The engine product series named Ecotec covers many displacements. In addition to the popular direct injection turbine technology, this LDK 2.0T engine also has a double scroll design and a double counter-rotating balance shaft, and low friction resistance optimization is adopted for some in-cylinder structures, so that it has a good balance performance in power performance and fuel consumption.

So the disadvantage of this engine may be that it is a little tired. When other people’s engines are constantly improving, this 2.0T engine doesn’t seem to have much optimization. Today’s car engines can give you a new gadget from time to time, and this LDK seems to have room for technical improvement compared with its competitors. But don’t forget, GM also has a 2.0T equipped on Cadillac. (To know about Cadillac 2.0T engine, poke the link: general LTG engine)

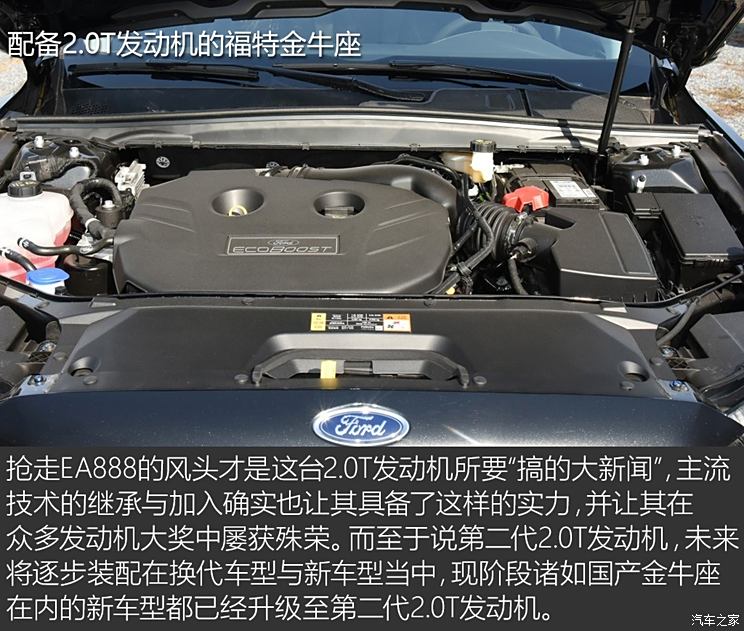

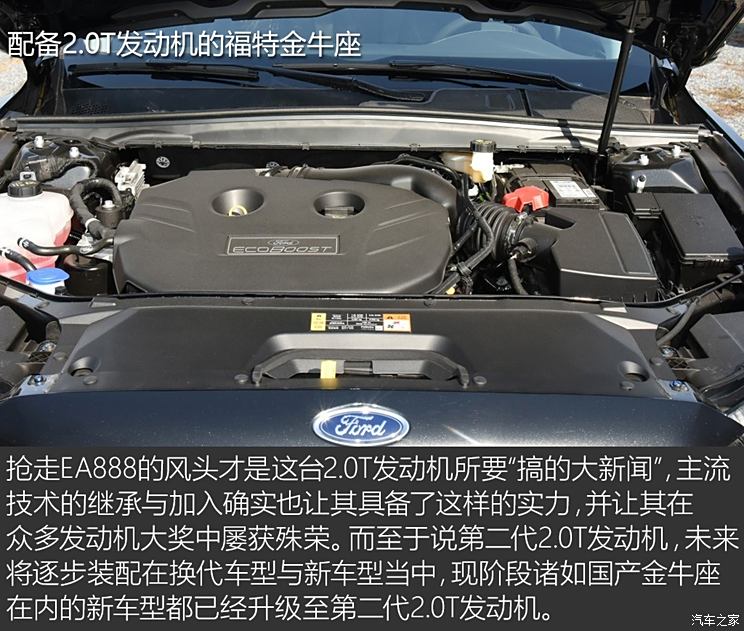

10. Challenging Volkswagen: Ford EcoBoost 2.0T

If EA888 is the beginning of the 2.0T war, then Ford’s EcoBoost is definitely a player determined to chop it down. Once launched, the high-power calibration added a lot of color to it (of course, there is a story here, which we will talk about later), and the sum of many technologies featured by EcoBoost really confirmed the strength of this engine.

Direct injection+turbine technology is inevitable, dual VVT timing adjustment and low inertia turbine are reasonable, and support lean combustion. Aluminum alloy cylinder head and balance shaft also add a lot of color to this engine. With dual clutch gearbox, this powertrain has a kind of Volkswagen "TSI+DSG" tonality. It seems that Ford is developing this set of things in a targeted way, and EcoBoost can also support hybrid power systems. Today, the latest EcoBoost 2.0T is actually the second generation product, which adds a double scroll design. For more advanced engine technology, they said that they will gradually try to apply it to the EcoBoost engine.

As for what kind of problems exist in this engine, it may be because Americans want to steal the limelight too much. The first generation of EcoBoost 2.0T engine has a virtual horsepower standard. Someone once pulled it to the power machine for testing. I wonder if it is the transmission efficiency. It is found that its actual output parameters are far from the calibration, which really makes many people disappointed. Of course, this is not to deny this engine. After loading, its actual dynamic performance has gained a lot of praise.

11. Squeeze to the limit: Volvo Turbo+Mechanical Supercharge 2.0T

If you want to find a mass-produced 2.0T engine with the most abnormal power output at present, Volvo must stand up and speak. In 2013, Volvo released its new DRIVE-E powertrain, among which a 2.0T turbo+supercharged engine attracted much attention. Up to now, in Volvo’s product line, this engine is definitely the master of the brand Hua Dan, and even a big guy like XC90 has entered the 2.0T era because of its birth.

A little different from many 2.0T engines, Volvo seems to want this engine to be squeezed to the limit. In addition to turbocharging and supercharge, the effect of this measure is bound to be beautiful: this engine can actually accelerate the 100 kilometers of XC90 with a self-weight of more than 2 tons to 7.26s! It seems that you don’t have to worry about the problem of small horse-drawn carts. Volvo has given a satisfactory answer.

As for whether there is anything unsatisfactory about this engine, according to some car owners around me, it may be because of excessive squeezing and high cylinder pressure, and this engine has the problem of burning oil. In addition, spit out Volvo’s engine product line. When is Lao Zhiliu going to use it to change it? (Want to know more about this engine? Poke the link: Volvo 2.0T)

12. No longer relying on others: Jaguar Land Rover Ingenium 2.0T

Since Land Rover evoque, Jaguar Land Rover has entered the 2.0T era. However, at the beginning, due to the influence of Ford technology, the 2.0T previously mounted on Jaguar Land Rover models used Ford’s first-generation EcoBoost 2.0T engine. Now that we have bid farewell to the Ford era, the second-generation EcoBoost 2.0T is no longer used by this "married prostitute", which gives Jaguar Land Rover the idea of developing a new series of engines-Ingenium series engines were born with the support of Tata in India.

The development focus of this engine is to ensure the power and reduce the energy loss as much as possible. In addition to the mainstream technologies mentioned many times before, the engine adopts the design of electronically controlled flow regulation in oil pump and water pump, and the newly designed balanced shaft ball bearing can also reduce energy consumption. The eccentric crankshaft is also designed to reduce energy consumption as much as possible and make the engine run smoothly and efficiently.

Having said so many advantages, we return to a serious topic: quality. I believe that many Jaguar Land Rover owners are worried about the quality control of this car. This new engine has brought a lot of advanced technologies, and the guarantee of reliability will face more severe challenges. So whether it can be done well depends on Jaguar Land Rover’s performance in the future. (Want to know about this engine? Poke the link: Jaguar Land Rover new engine)

13, unwilling to lag behind: Hyundai Theta II improved 2.0T

Having said so many 2.0T engines, what are Koreans doing? The general trend is that Koreans who are unwilling to lag behind will naturally develop their own 2.0T engines. Although it doesn’t have such a big limelight as the previous products, it seems that the 2.0T engine developed in modern times is also quite interesting.

Theta II improved 2.0T engine is an upgraded product, not a new development. It is based on part of the structural foundation of the old engine, by adding turbocharging and direct injection systems, and making some optimization and improvement designs. Don’t rush to deny this engine yet, because its technology also has some interesting points.

In a sense, this engine does have some bright spots, but it is undeniable that this is not a brand-new product. What is the potential of this evolved product to continue technological development in the future? It may all be the problems facing modern times at this stage. (Want to know about this engine? Poke the link: Hyundai 2.0T)

Editor’s summary:

Talking and laughing, we took stock of mainstream 2.0T engine products of many overseas brands. Although we may not talk deeply in many aspects, we can always see some trends: the future of 2.0T gold displacement direct injection supercharged engine is great, and various car companies are scrambling to add fresh technology to its 2.0T engine. What is the potential of 2.0T? Not only you and I want to know, but also car companies want to give it a try. In the next issue, we will take stock of some China-branded 2.0T engines. If you have any questions, please come to my editorial blog for further communication. (Text/Figure car home Shu Ning)

[car home Engine Technology] In the last issue, we talked about many mainstream overseas brands of 2.0T engines, but in the next issue, let’s stop worshipping foreign things and show you our own 2.0T engines. From my personal feelings alone, like everyone else, I hope that domestic engines can be equally divided with those "foreign powers" and even "abuse them to the north", but what is the truth? Come with me next.

Note: Again, this year-end inventory, please see the officials don’t cause bad influence in the comment area, each engine has its own advantages and disadvantages, please treat it rationally, thank you for your understanding.

● China Group: Some engines are not lost to imported products, and the prospects are bright.

1. Known as the best domestic 2.0T: SAIC 2.0T (Roewe RX5/ MG Ruiteng)

In 2014, the "Blue Core" engine series led by SAIC, with Pan Asia in charge of the main R&D and testing, and combined with some general engine technologies, will be gradually put into the brand models of SAIC. Among them, an engine code-named MGE 2.0T was assembled into the recently hot Roewe RX5 model and became the "core good friend" of this car.

Indeed, this engine series draws on some technical concepts of general Ecotec, but it is only at the conceptual level. It is completed by Chinese engineers from design and manufacture, technical realization to later development and debugging. That is to say, this 2.0T direct injection system, adjustable intake and exhaust timing, and integrated design of double scroll turbine and valve cover and camshaft cover are all designed and manufactured after considering the current technological level, engine durability and manufacturing cost. It is also known that this engine will be built in the future. Want to know more about this engine? Poke the link: analysis of SAIC 2.0T engine)

From a technical point of view, this engine can be regarded as a domestic benchmark, but compared with many overseas most advanced 2.0T engines, there is still room for upgrading in many details design and optimization. As for the fuel consumption, according to the feedback from the forum owners and our long-distance test vehicles, the fuel consumption of this engine (mainly referring to Roewe RX5 and MG Ruiteng) ranges from 10L to 14L, and the more reliable data is 12L, which can only be said that the performance is average, and the combustion efficiency can be optimized in the future. According to reliable sources, this engine will soon replace 4G63S4T used by Zotye and become the main 2.0T engine of some new models of Zotye in the future.

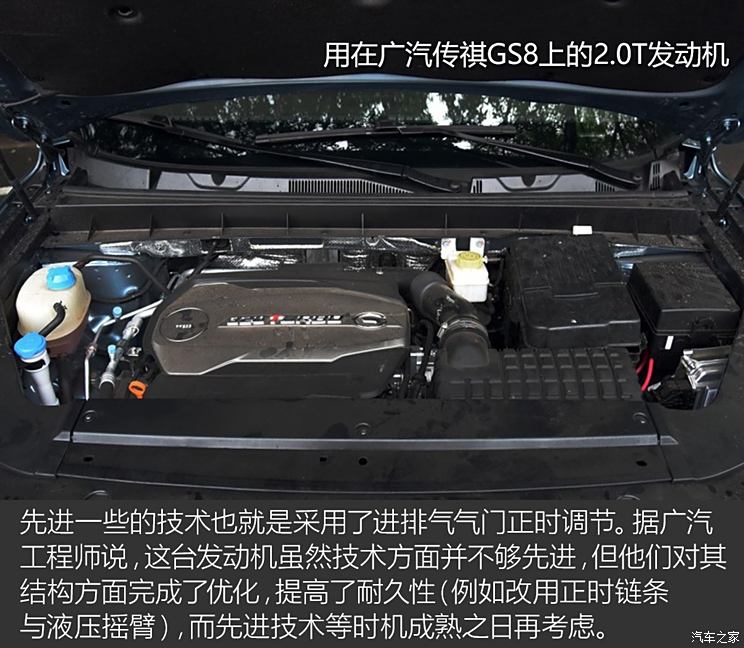

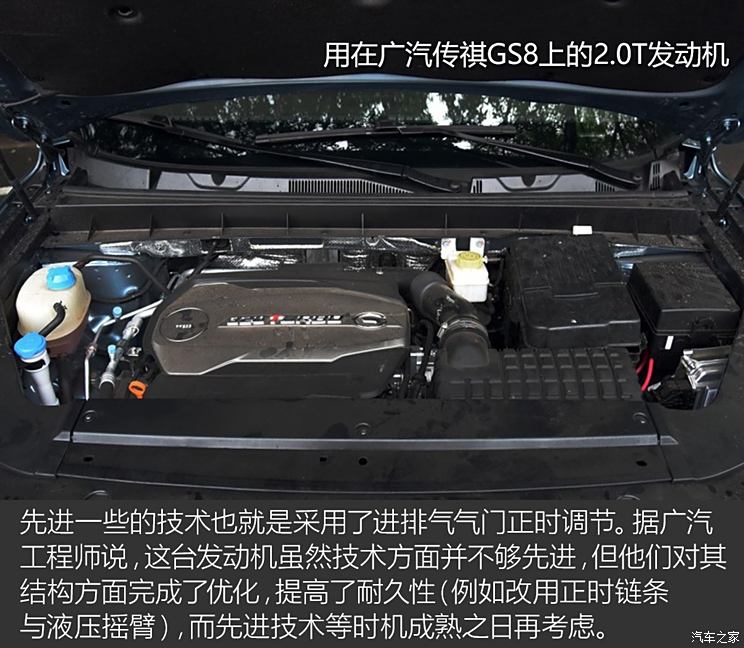

2. Slow and steady play: GAC 2.0T(GS8/GA8)

Although they are all "Southern School’s Concept of Building Cars" with relatively technical flow, GAC’s understanding of 2.0T is quite different from that of SAIC: at present, there is no gasoline direct injection system added to GAC’s 2.0T engine. GAC knows very well what they are doing: since I am not fully confident to do a good job in direct injection technology at this stage, I will do an EFI turbine engine in a down-to-earth manner, and optimize fuel consumption as much as possible, with durable leather and enough power.

For GAC, the significance of this engine is more to let people recognize the quality of this engine, which is simple enough to be used and repaired, and it is not blindly added in technology. In fact, this turbocharged engine code 4B20M1 2.0T used in Guangzhou Automobile GS8 is not the latest product. It has been assembled on the previous Guangzhou Automobile GA8 for some time and belongs to the second generation of 4B20 engine, which mainly optimizes the valve timing mechanism and engine durability.

From the measured results, it is shown that this engine also has a very mild feeling in terms of power output, and the power is sufficient. In addition, because the car model is too new, the actual comprehensive fuel consumption is hard to say for the time being. Finally, I have to spit out that a mature and stable engine, technical conservatism is a measure to ensure reliability, but at this stage it is too low, plus the iron cylinder block. I hope this "mature technology to ensure reliability" is not an excuse for this engine. I also hope that some new technologies popular at present can be put into mass production as soon as possible. After all, technology is improving and many advanced engine technologies are mature enough.

3. The confidence of the national generation: FAW 2.0T (Hongqi H7/ Pentium B90)

Speaking of FAW, some words always pop up in our minds from time to time: No.1 Automobile, the earliest automobile enterprise in China. It is true that as a pioneer of domestic cars, not only the motherland has high hopes, but also it carries the dream of making cars of more than one billion people in China. From this point of view, then FAW should set an example in terms of engine accomplishments. Although it is not as advanced as some brands of engines at this stage, this 2.0T engine has indeed achieved the exemplary role of pioneers.

Putting aside feelings and returning to the topic, what about this 2.0T engine of Hongqi? The official doesn’t seem to want to disclose too many details about this engine. As far as the information at hand at this stage is concerned, this engine, which was born a few years ago, has reached the level of GAC 2.0T and has been optimized in some details, which is commendable. Like GAC, as an early 2.0T engine product in China, this engine also adopts a relatively conservative technical strategy, which is EFI+iron cylinder block, with adjustable intake and exhaust timing and turbine support, and its power output is relatively soft, which is in line with its positioning on H7. (To learn more about this engine, click the link: Hongqi 2.0T engine)

Again, maturity doesn’t mean making excuses for not adding new technology. Cast iron cylinder+EFI is indeed Old Fashioned. Although the official has a prototype of the 2.0T engine blessed by direct injection technology, there is no accurate news about when it will be mass-produced. We should know that many brands of 2.0T engines have entered the second generation era, so it is really time to speed up the research and development of new technologies.

4. Saab technical support: BAIC 2.0T(BJ40/ Saab X65)

Speaking of BAIC’s 2.0T engine, there may be an expert friend who will talk about a question: Should BAIC have more than one 2.0T engine? In fact, regarding this conclusion, I also consulted many related engineers and insiders, and got a consensus that there is only one 2.0T engine from the perspective of BAIC brand.

Returning to the technology itself, this 2.0T engine (code B201R) used in many Beiqi models is not without a blueprint. If you know where the brand Sic Bo comes from, then you can boldly guess the source of this engine. Yes, a few years ago, Saab from northern Europe filed for bankruptcy protection, and BAIC invested in some technologies in Saab’s hands, including platforms and engines. Then the engine we are going to talk about today is not so much completely independent intellectual property rights as an optimized design based on Saab 2.0T engine. (If you want to know about the turbocharged engine of BAIC Saab technology, poke the old article link: BAIC turbine engine)

Since it is a good foundation, is this thing perfect? I don’t think so First of all, it is a big problem whether good things can be adjusted well without rich experience. Besides, this engine was absolutely second to none ten years ago, but now, who doesn’t have a turbocharged engine? Although BAIC has plans to add direct injection technology to it, at present, this engine seems to lack technical highlights except for the double-balanced shaft structure. On the other hand, GM has developed the Ecotec 2.0T engine with Saab technology, and BAIC has to make more efforts.

5. Get rid of Mitsubishi: Great Wall 2.0T(H6 Coupe/H7/H9)

Apart from Wuling Hongguang, which car dominates the famous autumn mountain, which other car can dominate in China and hang the same class? Perhaps the title reveals what I want to say. It is no accident that Haval H6 sells well. Even the success of Great Wall Motor is largely due to their "ability to make cars better". I will give you everything you want and I will give you what you expect. Of course, the price is still very cheap. Can it not sell well?

Like many car companies at that time, the early Great Wall Motor developed many products relying on Mitsubishi 4G63 engine. Today, Great Wall has its own R&D team, and this self-developed 2.0T engine (code-named GW4C20) has been assembled into many models. Of course, many people will have questions: Is this engine inextricably linked with 4G63? From the results of our existing data, there is no commonality between them (especially in terms of cylinder diameter, stroke and camshaft layout). Even from the perspective of research and development, this engine is much more advanced than 4G63, and even uses integrated design concept and double scroll turbine. (and understand the Great Wall direct injection engine? Poke the old article link: Great Wall Turbine Direct Injection Engine)

When it comes to the shortcomings of this engine, it must be that although it has reached the mainstream advanced level, there is still room for improvement in technology, such as how to better optimize combustion efficiency, and the engine technology is so advanced. When can the cast iron cylinder block that is not in line with the times be replaced? Have confidence in your own manufacturing process.

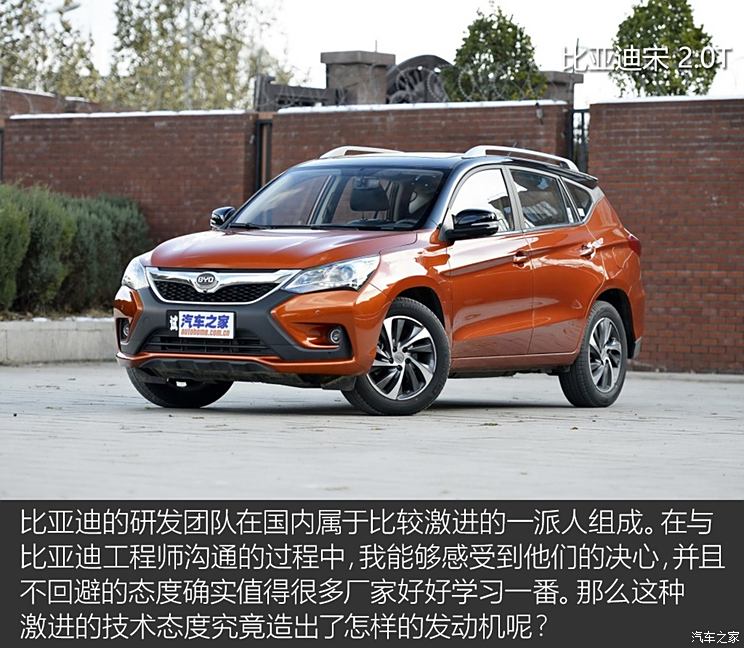

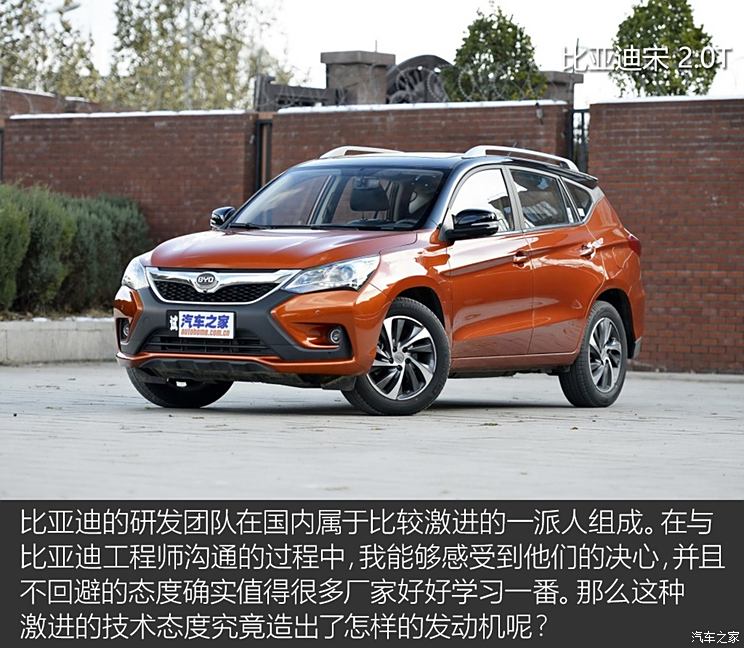

6. The heart of the fastest domestic car: BYD 2.0T (Tang/Song /S7)

To say BYD, this brand is definitely one of the China brands that have been pursuing advanced technology for a long time in China. Let’s not talk about the actual performance of the engine, at least we have the confidence to build an advanced domestic direct injection turbine engine, which deserves our praise.

Let’s start with our protagonist: the 2.0T direct injection engine code-named BYD487ZQA. This engine basically covers many mainstream engine technologies, such as variable timing adjustment of intake and exhaust, gasoline direct injection technology, single balance shaft and water-cooled turbocharging. It can still be seen that BYD’s level in engine can not be underestimated. The aluminum cylinder block also affirmed its own cylinder block manufacturing process from a certain angle, and BYD engineers said that they still have many directions to develop in the future to make this engine more advanced. (To know about this engine, poke the link: BYD 2.0T engine and wet dual clutch gearbox)

I am not a data party, so I don’t comment too much on parameters. So does this engine, which looks like many technologies, have its disadvantages? First of all, from the structural point of view, this engine seems to learn from the structures of Volkswagen EA888 and Volkswagen EA211, but there is still room for improvement in the matching and adjustment of the whole powertrain and gearbox. And from my personal experience, the working noise of the gasoline pump of this engine is indeed a little loud, and even the tonality of some diesel vehicles affects the texture. So is this slightly radical technical solution good or bad? If stability goes up, then advanced technology strategy is certainly a good thing.

7. Rising Star: Changan 2.0T(CS95)

Although in the current mass production products, Changan does not have a model equipped with a 2.0T engine, but just a few months later, changan CS95, which has undergone many design improvements, will be on the market, and this car will be equipped with a 2.0T engine of Changan Blue Core series. So what is the technical performance of this new engine?

Changan officially declared that this engine belongs to the product of 100% forward development, with good confidence, but we can’t draw a conclusion until we see the structure. In terms of technology, this engine has intake and exhaust timing adjustment, direct injection+turbine, all-aluminum cylinder block, integrated exhaust design, double balance shaft design and thermal management optimization system, and may also support mixed injection (EFI+direct injection) in the future, which seems to be advanced enough.

It looks beautiful, but what’s the problem? Still, as mentioned before, although it belongs to the domestic advanced level of 2.0T in terms of technology, I hope this is not the product of stacking technology. Adjustment has always been a shortcoming of many Chinese car companies. In addition, new technology means "new failure" in some aspects. How to make it run efficiently and stably and ensure the production process to meet the design and calibration requirements is a big problem that Changan will face in the future.

8. There are already optimized versions: JAC 2.0T (Ruifeng S5/M5).

Different from other brands’ aggressive promotion of their own 2.0T engines, Jianghuai seems to have been quietly equipping its Ruifeng S5 model with 2.0T engines (code-named HFC 4G3-1D), and has quietly optimized and adjusted it (code-named HFC 4G3-4D) and assembled it on MPV models like the new Ruifeng M5.

The original design intention of this engine is the same as that of some "conservatives". In order to reduce the cost of engine development and later maintenance, a conservative design and adjustment scheme was adopted. Except for variable timing adjustment of intake and exhaust and integrated design of exhaust manifold, other aspects showed a very common style. Jianghuai thinks that a 2.0T engine, instead of pursuing virtual high power output, should be down-to-earth and start with the most basic engine work-that is, how to make this engine run stably. (To know about this engine, poke the link: Jianghuai 2.0T engine)

In fact, these domestic brands with engine technology are nothing more than two ideas: either to be a mature and stable 2.0T engine with little technical content, or to be a 2.0T engine with advanced technology and high power output. Again, there are advantages and disadvantages between them. As for which is good or bad, it depends on your personal needs. Of course, from the perspective of technological progress, many such "conservative" 2.0T engines still need to work hard.

9. Baodao specialty: Dongfeng Yulong Nazhijie (excellent 6/ 7 MPV)

As an inseparable part of China, there is actually a 2.0T engine in Baodao Taiwan Province. Since Yulong Automobile and Dongfeng Motor jointly produced Nazhijie brand models, this seemingly special joint venture brand has spared no effort to provide us with their most advanced technology at present.

This 2.0T engine is equipped with Nazhijie ECO HYPER technology, that is, an electronic fuel-saving control system, which belongs to a collection of electronic controls and has the functions of starting and stopping the engine. Needless to say, the purpose is natural. In addition, this relatively new engine has finally been upgraded to variable timing adjustment of intake and exhaust, and the cast aluminum cylinder block is also used in the cylinder block material. The sincerity and technology are no less than many domestic 2.0T engines.

From these aspects alone, this engine seems not bad, but is it really that good? First of all, through feedback from some riders, we know that this engine is not very good in assembly reliability, and there are many minor faults. In addition, this engine is also conservative in parameter calibration, with a narrow torque output platform. In addition, it uses EFI instead of direct injection or mixed injection, so this engine seems to have many possibilities for improvement. Taiwan Province compatriots should also refuel.

10. China cousins who are not EVO: Southeast, Landwind, Zotye and Cheetah, etc. 2.0T

Yes, finally, we will talk about a semi-autonomous engine. Why do you say that? Because we are so familiar with this engine: our ancestors used the indestructible 4G63 and added a turbine. However, today’s protagonist is not the double overhead camshaft 4G63 used in the old EVO, but the Mitsubishi technology engine code-named 4G63S4T.

Don’t underestimate this engine. Although it is exhausted from a technical point of view, it does not affect its advantages of stable quality, simple and cheap maintenance, parts all over the country, repair with the deterioration, and reasonable power and fuel consumption. Even if I blow this engine dry, I won’t feel bad, because even if I buy a brand-new 4G63S4T, it is very cheap.

Then there is no need to say more about its shortcomings. There is almost no mainstream advanced engine technology. The single camshaft design seems to be the product of the last era, and the turbine lag is also serious. But again, who called it cheap and easy to repair? As a conservative power choice for many brands, it is still very suitable.

Editor’s summary:

After taking stock of overseas brands, we see that our own "China 2.0T" is also evolving step by step. Although for some brands, their engines still have some gaps with international standards, it is undeniable that the 2.0T era in China is coming quietly, and many brands have made it clear that they are developing their internationally advanced 2.0T engines. We are looking forward to having our own 2.0T engine that will make the world tremble, and I personally think that it is not far away, knowing that we in China are very diligent and the research and development speed is also very fast. (Text/Figure car home Shu Ning)

● Miscellaneous article: At the request of the readers, after taking stock of China engines, we will dig a little deeper for some 2.0T engines that are of high concern.

1. Mercedes M133 2.0T

In the previous article, I wrote about the relationship between Mercedes-Benz M133 and Mercedes-Benz M274. In fact, it is not difficult to understand that Mercedes-Benz will not redevelop an engine for an AMG model with a small output, but will design it based on the original framework. Then some people will ask, to what extent is this "based on the original framework"? According to AMG officials, apart from design dimensions (such as cylinder diameter and stroke) and some external parts (such as generators and starters), there are great differences in manufacturing technology and material selection of parts. And because the engine doesn’t pay much attention to the fuel-saving performance, they also canceled the valve lift adjustment on M274, in order to further reduce the internal resistance of the engine and realize the lightweight design. (Want to know M133? Poke the link: Mercedes-Benz 2.0T AMG engine)

2. Cadillac LTG 2.0T

The reason why this engine is concerned by the majority of netizens, I think it may also be because the output parameters are considerable. Indeed, this 2.0T code-named LTG has output parameters beyond the same level, but from its technical point of view, it does not actually show the "international advanced level". Let’s talk about the advantages first: this engine has been optimized in NVH, and the oil pump has realized the flow regulation function controlled by solenoid valve. The crankshaft adopts forging technology and adopts double scroll turbine design, which has many mainstream engine technologies such as intake and exhaust timing adjustment. (For more information about this engine, please poke the link: LTG engine disassembly)

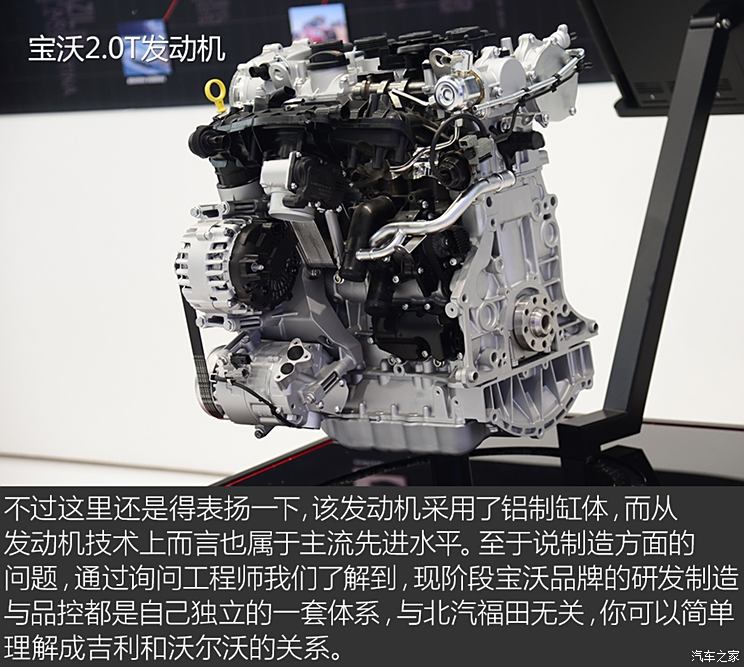

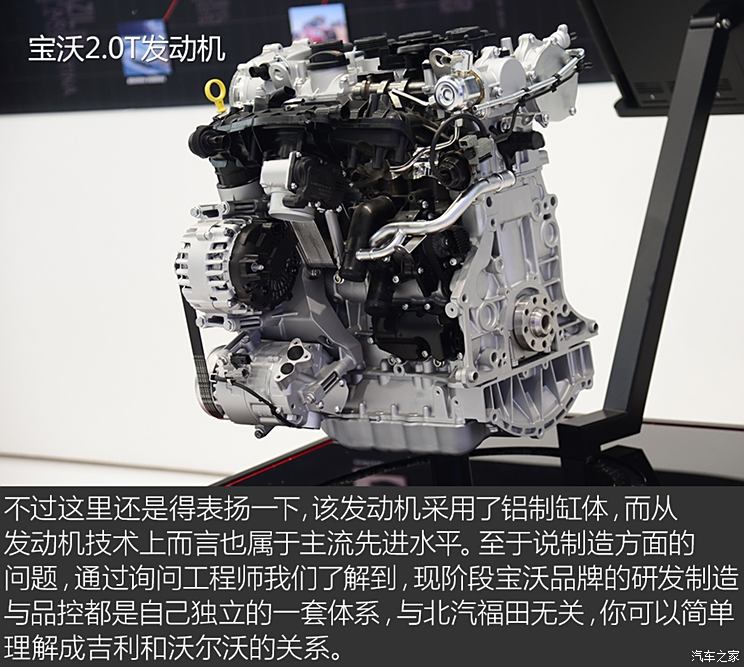

3. Baowo 2.0T

In fact, we have been discussing whether this engine is domestic or overseas for a long time. Later, I played a clever trick and put it here. We photographed this engine at the auto show, and I can tell you bluntly here: this is a slightly modified EA888 engine. No matter from the technical or structural point of view, it shows a high degree of consistency with Volkswagen EA888, and also integrates some characteristics of EA211. (To know about Baowo engine, poke the link: Baowo 1.4T/2.0T engine)

Full text summary:

After talking about so many 2.0T engines, I believe you are as big as me. Indeed, this displacement has a wide adaptability, and after comprehensive consideration of the 2.0T engine, you will find that this engine is a power system that is extremely suitable for the future trend, and it has advantages that cannot be underestimated whether it is the balance of output power and emissions or the integration with hybrid power systems. Of course, China’s 2.0T engines are also improving step by step, and we are delighted to see that some China brands have their own 2.0T engines that are not lost to overseas brands. I believe that one day, our own China cars will be able to dominate the world’s automobiles and become a national pride industry. (Text/Figure car home Shu Ning)

?

?