NIO "go down"?

The picture comes from NIO’s official website. If there is any infringement, please inform and delete it.

On March 1, NIO announced its financial report for 2022, with a net loss of 14.437 billion yuan in 2022, breaking the trend of gradually narrowing losses in the past two years. The market believes that it seems to return to the dilemma of being in the ICU in 2019. In comparison, Li Auto’s loss of 2.03 billion yuan is almost negligible.

Gross margin cut in half, expenses further increased, cash reserves dropped… The sustainability of NIO began to face widespread doubts, and the reaction of capital markets was more direct. On March 1, the US stock market closed down 5.96%. At $8.83, it reached a new low since the second half of 2020.

Li Bin and NIO are under great pressure.

But at the same time of huge losses, NIO is still up the ante. Recently, NIO announced that it will add 1,000 replacement stations this year to cover more markets in third- and fourth-tier cities. Li Bin believes that in addition to the first-tier market, there is still more market space to expand. The construction of the charging and replacement system is providing support for NIO to sell cars.

In addition, the Financial Union reported that NIO’s new factory settled in Chuzhou, Anhui, and will put into production NIO’s third brand Firefly. Unlike the high-end positioning of the NIO brand, Firefly focuses on low-end models, and the price range may be 100,000 yuan to 200,000 yuan, or even 100,000 yuan.

At this time, if combined with the construction plan of the power station just mentioned, it seems that NIO’s sinking ambition can be found. Around this phenomenon, this paper attempts to answer the following three questions:

1. Why are car companies obsessed with the lower-tier market?

2. NIO, which starts from the mid-to-high-end market, "goes down", the advantages outweigh the disadvantages?

3. Is the lower-tier market a piece of fat for new power car companies?

Competing for the lower-tier market

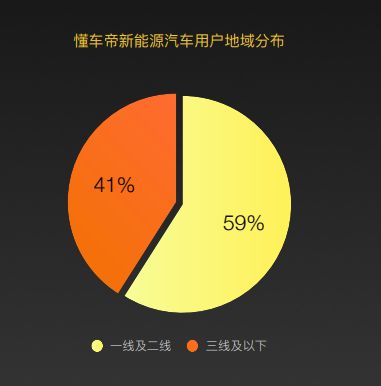

Dcar and the China Electric Vehicle 100 Association released the "Low-tier market new energy vehicle user consumption behavior insight report", which studies and analyzes the portrait user, car purchase behavior and consumption trend of new energy vehicles in third-tier and lower cities.

The report pointed out that the lower-tier market users in the purchase of vehicles, the choice of new energy vehicles than the proportion of first- and second-tier cities, compared to first- and second-tier city users on the appearance of interior, cutting-edge technology, lower-tier market users are more concerned about parameter configuration and model price, the 150,000 yuan models are more favored.

Lower-tier market share of population

Zhang Yongwei, secretary general of the China Electric Vehicle 100 Association, made it even more clear that the new energy vehicle market will accelerate in 2023, with sales in second- and third-tier cities expected to account for more than 60%.

At the same time, our country is also accelerating the construction of new energy vehicle charging facilities. Cities in the third- and fourth-tier and below are promoting the increase of charging infrastructure building by formulating local subsidies and setting the upper limit of charging service fees. According to the latest data released by the China Charging Alliance, as of October 2022, the cumulative number of charging infrastructure in the country was 4.708 million units, an increase of 109% year-on-year.

From the current market development situation, the third- and fourth-tier markets are likely to be the next incremental space for new energy vehicles, and demand is being released.

Therefore, not only NIO, but also other new car players are eyeing the lower-tier market.

As early as three years ago, Tesla publicly announced the central city settlement plan, covering a total of 45 cities in the four major regions of China, including Yancheng, Jiangsu, Linyi, Shandong, Nanning, Guangxi, Ganzhou, Jiangxi and other low-tier cities – which was also interpreted by the outside world as Tesla’s sinking plan.

In March last year, Tesla published an article on its official account, "Tesla Village in the Mountains," describing how Cai Ge, who grew up in Panzhiga Village in Yunnan Province, inspired the villagers to replace their oil carts with Teslas.

In addition to further increasing the exposure of the original product, Tesla plans to launch a new model that is more accessible to the people, and is equipped with a more powerful, safe and cheap new battery.

The best implementation of the lower-tier market is BYD.

Data show that from 2021 to 2022, BYD’s sales of several hot-selling models in third-tier and lower-tier cities increased from 30% to nearly 40%. As of September 2022, BYD’s store ratio in third-tier and lower-tier cities was about 50%, with nearly 800 stores. BYD is reaping the growth dividends of the new energy vehicle market with its cost-effectiveness and car cost advantages.

In addition, Li Xiang, chairperson of Li Auto, said that another focus of Li Auto in 2023 is to expand the network layout of third- and fourth-tier cities. It is expected to add 50 urban layouts and 150 stores, basically completing the coverage of third- and above-tier cities.

Xiaopeng is also offering cost-effective products to the wider market. Xiaopeng P5 has the "world’s first mass-produced lidar smart car" label, and the subsidized price is 157,900-223,900 yuan. Xiaopeng’s experience center has also begun to expand to cities such as Liuzhou, Luoyang, Weifang, etc.

Second, with Tesla’s heart, lean towards BYD

However, it is a bit regrettable that the players seem to be actively planning, with the exception of BYD, most of them have achieved little.

After analyzing the sales channels of new car manufacturers such as Tesla and Wei Xiaoli, some research institutions found that their stores are still concentrated in first- and second-tier cities such as Beijing, Shanghai, Guangzhou and Shenzhen, as well as in economically developed regions such as the Yangtze River Delta and the Pearl River Delta. Sales contributions also continue to come from these central cities.

But one thing is very interesting, today’s new car forces seem to be experiencing a "siege". Nezha and zero runners, who were originally developing steadily in the 100,000-200,000 yuan market, are focusing on the mid-to-high-end market to "gold-plated" the brand; while Wei Xiaoli, who is "looked up", hopes to use the lower-tier market to harvest more users.

From high-end to low-end, there are advantages and disadvantages. How should car companies choose? Huawei Smart Car Solutions BU CEO Yu Chengdong once said bluntly in an interview that he will not make a car within 200,000 yuan. But Che Bai think tank believes that small and beautiful cannot withstand big waves. For high-end car companies, it should impact the low-end market.

First, the high-end market is no longer attractive.

In the era when there were not so many new forces, Wei Xiaoli directly started building cars from the mid-to-high-end market, and after a period of relatively high-profile days, such as the Xiaopeng P7, NIO ES8, and Ideal ONE models, they all achieved very good results.

But Cui Dongshu, secretary-general of the Passenger Federation, said that in the current domestic new energy vehicle market, the sales of models under 200,000 yuan account for more than 50%, and it is expected that the market share of models under 200,000 yuan will be more than 70% in the future. This means that the high-end market where "Wei Xiaoli" is located is more than 200,000 yuan, which is not the fastest growing range.

Take NIO alone, Li Bin once proudly said that the average price of NIO exceeded 400,000 yuan. From another perspective, 400,000 yuan has also become a gap between NIO and the vast majority of users. If NIO wants to further increase its market share, it must enrich its product system, and sinking is an inevitable choice.

Secondly, the delivery volume is an important indicator of capital to see new power.

The logic is that the automobile industry has a strong economy of scale. In their book The Automobile Industry, the British economists Maxi and Silberstone argued that only mass production of cars can make prices more acceptable to consumers, and then consumers can promote product delivery, and a positive flywheel will run. And capital is also a big fan of this theory, so delivery is their primary consideration.

However, under the premise that high-end tram sales cannot increase rapidly, NIO’s delivery volume is worrying, and it has been forced to relinquish its top position in delivery volume since 2021.

NIO’s top priority now is to find new growth poles.

At this time, the launch of Alpine and Firefly sub-brands corresponding to the low-end market may be the key breakthrough for NIO to reverse the situation. If it enters too late, the market price may be divided by BYD, Tesla and other car companies, and it will be difficult for NIO to get a share.

The advantage of the high-end market lies in profit margins, while the advantage of the mid-to-low-end market is that it can move volume and provide higher risk resistance in times of economic crisis. Therefore, even with Tesla’s heart in mind, NIO has to rely on BYD.

Fortunately, NIO has obvious advantages in attacking the lower-tier market. For companies based in the low-end market, it is extremely difficult to move to the high-end market. In turn, high-end car companies sink into the low-end market, but it is much simpler. Price reduction and reduction are common solutions.

In addition, NIO has an advantage over other car companies, which is the power station. In Xingfu Town, Boxing County, Binzhou City, Shandong Province, NIO has 500 car owners, and the town’s household registration population is only 50,000. The reason why so many people are willing to buy NIO is because of the local construction of the power station.

When NIO’s charging stations are ubiquitous, it is difficult for other brand car companies to replicate them.

III. It is difficult to steal business from someone else’s mountain

The advantage is not small, but the problem of NIO entering the low-end market cannot be ignored. One of the keys is how much money NIO still has. When NIO went public in Hong Kong in early 2022, it revealed that the cash reserve was about 60 billion yuan, but NIO’s net loss in 2021 exceeded 10 billion yuan, and the net loss in 2022 exceeded 14.40 billion.

In addition to the loss mentioned at the beginning of the article, as well as spending huge sums of money to build and replace power stations, NIO will continue to build up the ante self-made battery, successively established (Shanghai Jiading) laboratory, set up research and development, manufacturing, sales (Anhui) company, 400 million yuan to invest in Xinganda, 12 million Australian dollars to subscribe to 12.6% of the shares of the Australian Mining Company (GR). Some time ago, Jianghuai Automobile acquired some assets of NIO at a price of 1.704 billion yuan, and many media believed that Jianghuai was assisting NIO.

Secondly, downward derivative models are not technically difficult for NIO, butBuilding a low-cost model is not easyAnd with the decline in raw material prices, the electric vehicle market is very likely to usher in a new round of price cuts to further compress NIO’s gross margin. At Tesla’s just-concluded investor day, Musk said that its models can further reduce costs by 50%. This undoubtedly poses a huge challenge to local new car makers such as Wei Xiaoli.

Moreover, Che Bai think tank checked the data of new energy vehicles to the countryside activities and found that traditional car companies are the well-deserved main force – BYD, Great Wall, SAIC, Jianghuai, Dongfeng, Chery and other traditional old car companies, vehicles are mostly small and mini cars priced below 100,000 yuan and with a cruising range of less than 300 kilometers.

In 2022, only a few new car brands such as Zero Run and Hezhong participated in the new energy vehicle to the countryside activity, and all "Wei Xiaoli" were absent. Why did this happen?

Different from traditional fuel vehicles, new energy vehicles put forward higher requirements for the after-sales services of automobile companies and the construction of local charging pile supporting facilities. Traditional car companies have more scale advantages in production and more perfect channel construction in the lower-tier market.

It is undeniable that the lower-tier market is the next traffic depression, but for most current car players, it is also a place full of thorns. Is the traditional car company relying on favorable terrain to continue to advance, or is the new force swooping into the battle? It is still unknown, but it is not up to NIO to choose.

Looking back at the price of Tesla Model X at that time, which was nearly one million yuan, it firmly stood in the position of a high-end brand, but since 2010, Tesla has been in a state of loss, and even reached the brink of life and death. It was not until 2016 that Tesla turned to the public to make a profit. Therefore, we might as well give domestic new cars some more time.

[Full text reference]

[1] "Insight Report on Consumption Behavior of New Energy Vehicle Users in the Lower-tier Market", China Electric Vehicle Hundred People’s Association & Dcar

[2] "BYD’s" price increase ", how long can it" sell the crown "?", inside and outside the table, Insight Data Research Institute

[3] "New energy vehicles enter the fourth year in the countryside, and the market needs more efforts to sink", China Consumer News

[4] "Tesla Village in the Mountains", Tesla Tesla