Huawei’s first product "Enjoy the World" in Beiqi Blue Valley will be unveiled soon (with shares attached).

The first product of "Enjoy the World" in cooperation with Huawei will be unveiled at the Beijing Auto Show.

The first product of "Enjoy the World" will be unveiled soon.

Recently, a summary of the exchange was exposed. The exchange minutes show that the first product of "Enjoy the World" in cooperation with Huawei will be unveiled at the Beijing Auto Show and released in June. The car is positioned as an executive car, with an internal price of 300,000-500,000 yuan. The follow-up model planning includes but is not limited to recreational cars, SUVs and other products. The annual production capacity of Beiqi Langu Zhixuan car is planned to be 300,000 vehicles, and it is estimated that the monthly sales volume of the first product in the world will exceed 10,000 vehicles.

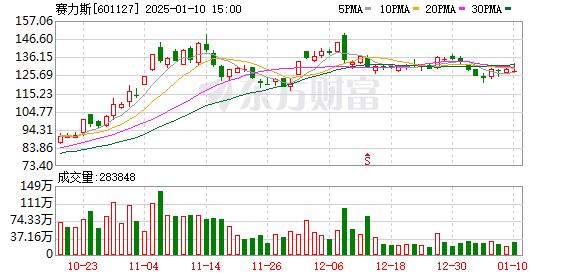

Boosted by this news,Baw blue valleyOn March 11th, the daily limit reached 123,700 lots.、、Wait for a crowdConcept stocks also surged, with increases of more than 7%.

Previously,Baw blue valleyAccording to the interactive platform, the "Enjoy the World" created in cooperation with Huawei under the smart selection mode will come out soon. The first product is a smart car for the high-end market. It is planned to establish a distribution and service network in Asian and European markets in 2024 to push this high-end car to overseas markets.

These auto stocks are highly related to Huawei.

According to the statistics of Times and DataBao, some concept stocks have performed brilliantly. From the ups and downs since February, onlyIt fell slightly by 2.19%. Among them,, Beiqi Blue Valley,、The increase was the highest, with 79.9%, 53.08%, 43.53% and 38.42% in turn;、、、The cumulative increase is over 20%.

In terms of performance growth, it is calculated by the median value of annual report data or forecast.、、The net profit of three shares in 2023 doubled year-on-year, with the growth rates of 176%, 108.59% and 106.4% respectively. Otherwise、、The net profit of all three shares increased by more than 80%.

It is estimated that the net profit of returning to the mother in 2023 will be about 1.089 billion yuan, a year-on-year increase of about 176%. In 2023, the production and sales volume of the world’s major automobile markets picked up, the supply chain gradually stabilized, smart electric vehicles developed rapidly, and the operating environment of the automobile industry improved. Thanks to the continuous heavy volume of domestic and foreign customer orders, the company’s various businesses continue to maintain a good momentum of steady growth.

Up to now, it has been completed.The full coverage of TOP10 car sales, and the intelligent cockpit solution cooperated with Huawei have been mass-produced on various Huawei models such as Wenjie and Zhijie.

In terms of performance scale,,, Junsheng ElectronicThey are all above 1 billion yuan, which are 30 billion yuan, 2.15 billion yuan and 1.089 billion yuan in turn;、Both are above 500 million yuan. There are still two unrealized profits, namely,Continued loss of 2.4 billion yuan;Beiqi Blue Valley,Continued losses of 5.45 billion yuan.

SeresThe sales volume of the cross-border models that cooperated with Huawei Intelligent Car Selection has always remained high. According to the data, AITO series delivered a total of 21,142 new cars in February, ranking first in the sales of new power brands in China market. Among them, the monthly delivery volume of the new M7 in Wenjie exceeded 18,479 vehicles, and the cumulative delivery exceeded 100,000 vehicles. From January to February, 2024, the AITO series delivered a total of 54,115 vehicles.

The gratifying sales also drove the company’s share price to continue to climb. Since February,SeresThe cumulative increase of the stock price was as high as 79.9%. On March 11th, it hit an all-time high of 103.89 yuan/share, and the latest price was 102.2 yuan/share. The company’s performance in 2023 was pre-deficit, with losses ranging from 2.7 billion yuan to 2.1 billion yuan, mainly due to high R&D investment, fixed expenses, sales expenses and raw material costs.